Analysis of Financial Assets in Colombia: Hedging Positions with Bitcoin

Análisis de activos financieros en Colombia: cobertura de posiciones con bitcoin

Received: August 04, 2022

Accepted: June 26, 2023

Escobar Anduquia, C. D., Avella Jiménez, S. D., & Rojas Ormaza, B. R. (2023). Analysis of Financial Assets in Colombia: Hedging Positions with Bitcoin. Revista CEA, 9(21), e2481. https://doi.org/10.22430/24223182.2481

Abstract

Purpose: To infer which financial assets in Colombia should be hedged with Bitcoin positions and determining their correlation with that cryptocurrency. In addition, this study seeks to improve our understanding of cryptocurrencies (Bitcoin in particular) in order to promote their use and applicability as investment vehicles.

Design/methodology: This study used a Dynamic Conditional Correlation (DCC) model, which can incorporate the dynamic correlations and variability of time series when they are volatile. Furthermore, this model offers the univariate flexibility of the Generalized AutoRegressive Conditional Heteroskedasticity (GARCH) model, which can be used to find moments that make the volatility tend to a balance, while evaluating pairs of variables, to provide coefficients that improve the distinction between and interpretation of diversification, safe heaven, and coverage.

Findings: The results show that the coefficients produced by the model can be employed to determine the properties of Bitcoin as a hedging mechanism against some fixed and variable income instruments in the national market. They also indicate that Bitcoin cannot be used as a safe haven for all the assets studied here. This gives investors more arguments for decision-making.

Conclusions: This study supports the idea that Bitcoin is suitable to be used as an innovative investment product in the Colombian economy because its characteristics make it a financial asset that can be employed to build portfolios and hedge against financial risks.

Originality: According to the application of this econometric model and the analysis of its outputs, education in digital assets should be promoted. This is because, in the long term, digital assets become solid and profitable, providing an opportunity to generate earnings at an adequate risk level—which is interesting to investors.

Keywords: Bitcoin, DCC model, hedging, safe haven, portfolio diversification.

JEL classification: F30, G10, G11, G12.

Highlights

Resumen

Objetivo: inferir los activos financieros del mercado colombiano que pueden ser cubiertos mediante posiciones con bitcoin, determinando el vínculo frente a dicha criptomoneda, así como contribuir al entendimiento de las criptodivisas (en este caso en particular, al bitcoin), en pro de su uso y aplicabilidad como vehículo de inversión.

Diseño/metodología: este estudio usó un modelo de correlación condicional dinámico (DCC), el cual tiene capacidad para recoger las relaciones dinámicas y la variabilidad de las series en el tiempo cuando son volátiles y brinda la flexibilidad propia univariante del modelo autorregresivo generalizado condicional heterocedástico (GARCH), que permite encontrar momentos donde la volatilidad tienda a un equilibro que proporcione coeficientes, el cual, al evaluar pares de variables, favorece la diferenciación e interpretación entre diversificación, refugio seguro y cobertura financiera.

Resultados: los hallazgos evidenciaron que los coeficientes proporcionados por el modelo permiten concretar las propiedades del bitcoin como mecanismo de cobertura de riesgo frente a algunos instrumentos de renta fija y variable del mercado nacional, así como la inhabilidad de su uso como refugio seguro para todos los activos estudiados, por lo que contribuye para que los inversionistas cuenten con más bases para la toma de decisiones.

Conclusiones: esta investigación soporta que el bitcoin es apto para ser utilizado como un innovador producto de inversión en la economía nacional, dado que posee características que lo convierten en activo financiero, con enfoque hacia la construcción de portafolios y generación de coberturas frente a riesgos financieros.

Originalidad: a través de la aplicación del modelo econométrico y el análisis de sus salidas, surge la necesidad de comenzar a difundir educación en activos digitales, debido a que en el largo plazo desarrollan solidez y rentabilidad, lo que genera la oportunidad de lograr beneficios bajo un adecuado nivel de riesgo, siendo materia de interés para inversionistas.

Palabras clave: bitcoin, modelo de correlación condicional dinámico (DCC), cobertura de riesgo, activo refugio, diversificación de portafolio.

Clasificación JEL: F30, G10, G11, G12.

Highlights

1. INTRODUCTION

All investors around the world need to mitigate their losses, or at least maintain the value of their portfolios—especially in times of economic crises, such as the recent health crisis derived from the COVID-19 pandemic. However, traditional safe-haven assets (e.g., gold) have lost investors’ trust because their behavior during the different stages of the pandemic was not constant. As a result, their capacity to serve as hedging or safe-haven assets depended on the particular conditions of the macroeconomic environment when the virus was spreading, offering hedging for different assets at each stage (

Technological progress constantly brings about new innovations (

Currently, the phenomenon of cryptocurrencies is growing stronger (

In recent years, cryptocurrencies have become especially relevant for investors and financial markets (

Taking this into account, this study—unprecedented in the local context—uses a Dynamic Conditional Correlation (DCC) model to determine it there are financial assets in the Colombian market that can hedge Bitcoin positions, thus exploiting its decentralized operation and using it as a diversifier or safe-haven asset. For that purpose, we will isolate the possible economic, environmental, and operational risks of cryptocurrencies, as well as those regarding illegal activities and other related factors. This is because we will try to evaluate the benefits of Bitcoin as a hedge, examining similarities, differences, and possible correlations with other assets. That is, this study aims to evaluate hedge relationships between assets—but it leaves aside the discussion about the way it would be applied, recorded in the books, and legalized as investment within the law, which can be investigated in future research.

2. THEORETICAL FRAMEWORK

Bitcoin

Due to its characteristics, there are multiple definitions of Bitcoin. However, it is clear that it has had an impact on the financial field, is considered to be the result of globalization, and works as a system of digital money. Bitcoin is a digital currency that only works over the internet, and, for this reason, it is known as decentralized digital money. In addition, it is accepted and used in at least 154 countries (

Uses

When Bitcoin was created in 2008 as the first cryptocurrency, incentives were offered to use it in commerce due to its novel (although questionable) characteristics—so much so that a sector of the population now thinks that this is the currency that will change the world, while others hold that it is a new speculative bubble that will burst at some point (

Regulations

The topic of the regulations on and self-management capability of this cryptocurrency covers other broad concepts, such as the determinants of trust and risks. As this virtual currency has only existed since 2008, its acceptance and use have not been thoroughly studied (

Acceptance

Bitcoin was a pioneer as the first decentralized cryptocurrency, and it continues to lead cryptocurrency markets in terms of market capitalization and the interest it draws in the scientific literature (

Investment

It is well known that there is no definite set of variables that can provide the exact price of Bitcoin because there are systematic and unsystematic factors that also affect its value considerably (

Price

Its benefits and disadvantages, as well as the diversity of its uses, make it impossible to estimate the price of Bitcoin, which has been studied using predictive models. These models have concluded that the important variation in its price hinders the construction of a stable model that can make projections in accordance with reality (

Nature

From a monetary perspective, cryptocurrencies have the characteristics of some currency structures to be considered a payment method. However, their economic nature has not been defined because they exhibit a small positive dependency between some of them, such as Bitcoin, Ether, and Ripple (

Blockchain

Bitcoin and the blockchain technology in general can bring efficiency, transparency, and security to financial markets (

Hedge accounting

Another argument in favor of using Bitcoin as a hedge is that hedge accounting can be performed applying the International Financial Reporting Standards (IFRS). In this regard, the IFRS 9 establishes three cases to proceed: cash flow hedge, fair value hedge, or net investment hedge. The goal of the first kind of hedge is to prevent accounting asymmetry, considering that, under the circumstances, it is preferable to show the constant results over the accounting period, without the impact of volatility (

Diversifier, hedge, and safe haven

A financial asset in an investment can have three possible uses. First, it can be a diversifier, that is, an asset that is, on average, positively correlated to another asset. Second, a hedge is an asset that is, on average, uncorrelated or negatively correlated to another asset. Third, a safe haven is the same as a hedge, but limited to specific periods of time, such as moments of market stress or economic crises (

As it is well known, cryptocurrencies are not part of the Colombian stock market, and the regulated institutions are not authorized to trade in them. This—in addition to the price instability, speculation, and anonymity that surrounds them—produces uncertainty in many investors (

3. METHODOLOGY

Bitcoin is attractive due to its profitability—derived from the high and significant variation in its price. Therefore, it has drawn the attention of a group of investors that have low risk aversion and expect to benefit from its sudden price fluctuations. In this scenario, this study aims to investigate a group of financial assets that can reduce the variance in Bitcoin yields, serving as a counterweight to this digital asset and minimizing the risk in this kind of investment. This study aims to investigate the behavior of these assets over time using, first, descriptive statistics and, second, the Dynamic Conditional Correlation (DCC) model. The DCC model includes the univariate flexibility of the Generalized AutoRegressive Conditional Heteroskedasticity (GARCH) model to investigate correlations (

This model has been implemented to establish if Credit Default Swaps (CDS) serve as hedges against risk in stock market sectors (

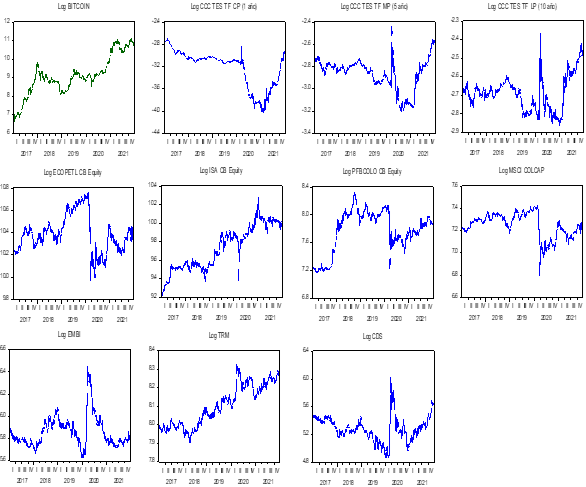

Data

This study aims to analyze the relationship between Bitcoin and several financial assets/indicators in the Colombian market. Therefore, the first data series in this study is the daily yields of Bitcoin. In addition, the yields of ten other assets/indicators are analyzed by pairs of variables. These fixed- and variable-income assets and indicators represent the behavior of the Colombian market. The data cube employed in this study contains 1,180 daily observations for each variable, which cover the period from January 4, 2017, to December 30, 2021. In Colombia, December 31 is a business but non-banking day. As a result, there are no observations of the assets on that date. The daily yields (variation with respect to the previous price) were calculated using the natural logarithm of the quotient between the final price and the starting price. That is, we work with a logarithmic profitability to eliminate the problems of the simple profitability in statistical models.

Most variables selected in this study represent assets and indicators in the fixed-income market. Colombian treasury bonds were included because these public debt securities exhibit the highest trading volume in the Colombian Stock Market (BVC in Spanish) compared to corporate securities and shares. Therefore, we assume that these assets are the ones that best reflect the market sentiment. The sample takes the Zero-Coupon Curve (ZCC) of Colombian government treasury bonds (called TES) with maturities in the short, medium, and long term in order to capture the market sensitivity along the curve. These TES can have fixed-term (FT) maturities of 1, 5, or 10 years, as follows: 1Y FT TES, 5Y FT TES, and 10Y FT TES. Additionally, this methodology includes the J.P. Morgan Emerging Markets Bond Index Global (EMBI), which represents the returns of the debt instruments (bonds) of emerging markets, as well as the 10-year Credit Default Swaps (CDS) of the Colombian government. These CDS reflect the cost of hedging for bondholders in Colombia, that is, they reflect the market expectations regarding country risk due to sovereign default.

For variable-income securities, the reference index in the sample is the COLCAP index, which is the main stock index in Colombia (recently adopted as the MSCI COLCAP index). Additionally, three securities were taken separately: Ecopetrol (ECOPETL CB), Interconexión Eléctrica SA (ISA CB), and Bancolombia preferred stock (PFBCOLO CB). According to their share in the COLCAP index, these are the three most liquid stocks in the Colombian market. The purpose was to select stocks liquid enough to adequately reflect the behavior of the market. In addition, these companies belong to sectors that drive the Colombian economy, such as energy (oil and electricity) and banking.

Regarding indicators, this study used the currency exchange rate that represents the price of 1 US dollar in Colombian pesos—called TRM in Spanish. The TRM is calculated and certificated by the Financial Superintendence of Colombia based on the purchases and sales of US dollars reported by financial intermediaries the previous business day.

Descriptive statistics

As a preliminary analysis of the market variables mentioned before, this study assessed their main individual characteristics in terms of the historic behavior of their returns. Table 1 summarizes their main statistics, which provide information about the location, dispersion, and shape of the data. The minimum and maximum values show that the yields can fall within a considerably wide range. In this table, Bitcoin is the variable with the lowest minimum percentage and the highest mean and standard deviation. It is followed by CDS, except for its mean percentage, which is lower than that of other assets/indicators. Only two out of the eleven variables in the table present negative mean yields: EMBI and ZCC 1Y FT TES. Among the equities, ISA CB exhibits the highest mean yield, the lowest standard deviation, and a positive asymmetry coefficient. In general, all the series have positive or negative asymmetries and are leptokurtic. This indicates that these assets are attractive to investors who are building portfolios that are more likely to produce higher yields, although exposed to greater risk (

Tabla 1. Estadística descriptiva de los rendimientos diarios

Serie | Minimum | Maximun | Mean | Standard deviation | Asymmetry coefficient | Kurtosis |

BITCOIN | -46,473% | 22,512% | 0,323% | 5,129% | - 0,704 | 7,947 |

TRM | -2,493% | 5,931% | 0,026% | 0,707% | 0,604 | 5,028 |

EMBI | -8,857% | 16,017% | - 0,008% | 1,628% | 1,648 | 14,226 |

CCC TES TF CP (1 Y) | -17,904% | 13,808% | - 0,026% | 2,100% | - 0,260 | 14,761 |

CCC TES TF MP (5 Y) | -12,464% | 18,131% | 0,018% | 1,533% | 1,701 | 37,757 |

CCC TES TF LP (10 Y) | -11,729% | 12,529% | 0,014% | 1,329% | 0,902 | 31,404 |

MSCI COLCAP | -16,290% | 12,470% | 0,002% | 1,288% | - 2,062 | 45,382 |

ECOPETL CB Equity | -15,363% | 13,997% | 0,036% | 1,832% | - 0,541 | 10,341 |

PFBCOLO CB Equity | -22,399% | 12,260% | 0,079% | 2,297% | - 0,924 | 12,291 |

ISA CB Equity | -8,406% | 13,868% | 0,094% | 1,805% | 0,600 | 6,097 |

CDS | -24,354% | 29,866% | 0,011% | 2,703% | 0,623 | 21,276 |

Figura 1. Comportamiento de los rendimientos

Source: Own work, 2022.

DCC model

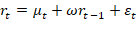

To ease the application of the DCC model given the volume of data examined here, the estimation is performed by pairs of assets. As a result, the model is composed of five equations divided into two steps. In the first step, an univariate GARCH (1,1) model is estimated. In the second one, the conditional correlations over time are obtained based on the standard residuals generated in the first step (

The model is detailed in Equations 1 and 2, as follows:

(1)

(1)

(2)

(2)Where rt is the vector of the price return of Bitcoin; μt the conditional vector of returns; ω rt-1 the return of the other asset, which is obtained as the first difference of the logarithm of closing prices; εt, the vector of the standardized residuals; Ht, the conditional covariance matrix; Dt, a diagonal matrix of conditional time-varying standardized residuals, which are obtained from the univariate GARCH (1,1) model; and ρt, the matrix that contains the conditional correlations.

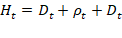

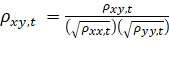

To get the DCC (1,1) model, we start from Equation 3 ρt, which is a square positive-definite matrix:

(3)

(3)Where ρt is the time-varying conditional correlation matrix of εt; α and β are parameters that represent the effects of previous shocks and previous DCCs on the current DCC; and ρ ͞ is the value that ρt would take when α and β are equal to zero.

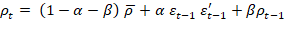

The DCC between financial assets X and Y is obtained as follows in Equation 4:

(4)

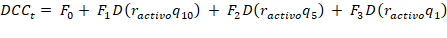

(4)Finally, to determine if Bitcoin is a diversifier, hedge, or safe haven against a variety of Colombian financial assets, we used the same method applied by

(5)

(5)From this, we can establish that Bitcoin is a weak hedge against another asset if F0 is zero, or a strong hedge if F0 is significantly negative. It is a diversifier against the other asset if F0 is significantly positive. In turn, it is a weak safe haven if the factors F1, F2 and F3 are not significantly different from zero, or a strong safe haven if they are significantly negative.

4. RESULTS

To obtain the final equation of the DCC model, we first established a simple linear regression model for each return variable. Then, the residuals were obtained, and, using the heteroscedasticity test, the series were classified as suitable to be treated in a GARCH (1,1) model. Afterward, these series became part of the DCC model, which is estimated in two steps. The main result of this was the dynamic conditional correlation of each pair of series. Next, the dummy variables were generated by extracting the percentiles from the initial return series.

The outputs of the final model were calculated using EViews software and are presented in Table 2. This is the result of running a multiple linear regression model with the components found in Eq. (5). Thus, we obtained the coefficients that are necessary to analyze factors F1, F2 and F3 and then validate the properties of Bitcoin. That is, we can establish its usefulness as a hedging mechanism against other assets in Colombia or vice versa. We can also determine the possibility of using it to diversify portfolios and as an investment vehicle for safe haven—the latter considering that its volatility should be lower than that of the other assets.

Tabla 2. Estimación del modelo DCC-GARCH (1,1)

Serie | F0 (Hedge) | F1 q (10%) | F2 q (5%) | F3 q (1%) |

TRM | 0,685157*** | - 0,801637*** | - 0,954382*** | 0,364564 |

EMBI | - 0,068149*** | - 0,251017** | - 0,556723*** | 0,568688** |

CCC TES TF CP (1 Y) | - 0,610034*** | - 0,530399*** | 0,001522 | 0,003032 |

CCC TES TF MP (5 Y) | - 0,391580*** | - 0,608095*** | 0,000574 | 0,003091 |

CCC TES TF LP (10 Y) | - 0,177155*** | - 1,121682*** | - 0,020376 | 0,003198 |

MSCI COLCAP | - 0,009041 | - 0,818121*** | 0,198053 | 0,723640*** |

ECOPETL CB Equity | 0,052545** | - 0,885138*** | 0,260139* | 0,265986 |

PFBCOLO CB Equity | - 0,339893*** | 1,356429*** | 0,007469 | - 0,255640 |

ISA CB Equity | 0,617309*** | 0,431792*** | 0,130651 | - 0,289030 |

CDS | - 0,248808*** | - 0,724228*** | 0,246201 | - 0,215644 |

Note: ***, **, * indicates statistical significance at the 1%, 5%, and 10% levels, respectively.

Analysis of the final model

The data in the model above indicate that, in general, Bitcoin can be a solid hedging alternative against several assets in the Colombian market: TES with different maturities, Bancolombia preferred stock, and CDS. All of them exhibited negative coefficients in their series. This is explained by the fact that TES are free from credit risk because they are public debt, and CDS serve their purpose as financial derivatives that hedge against the default risk of another asset. In turn, Bitcoin seems to be a weak hedge against the EMBI because the parameter of the latter is close to zero, which can be due to the lower volatility of its returns compared to those of Bitcoin. It should be noted that, although the factors of TRM, ISA CB Equity, and ECOPETL CB Equity were positive and not close to zero, Bitcoin does not provide a hedge against them. Nevertheless, Bitcoin can be a diversifier for them because their yields (although positive) have a lower volatility than those of Bitcoin. Finally, there is no statistically significant evidence that indicates that this cryptocurrency is a hedge against the MSCI COLCAP index.

The positive and negative coefficients far from zero of the factors that represent the different percentiles in the model indicate that, in general, Bitcoin cannot be considered a strong or weak safe haven against any of the variables examined here or vice versa. This can be justified by phenomena that are not considered in the regression, e.g., the effect of the coronavirus on the economy, the impact of oil prices, or inflation. Together with other macroeconomic aspects, these phenomena have had an impact on the returns of the ten assets/indicators analyzed here, even Bitcoin—which has been demonstrated to respond with greater price variation to market forces (supply and demand) and speculation.

Considering this, it can be argued that, in the last five years, the Colombian market has had (fixed- and variable-income) instruments that can be hedged with Bitcoin. Nevertheless, when they opt for these assets, investors are exposed to interest rate, reinvestment, inflation, credit, liquidity, and market risks, among others. Table 3 summarizes the possible uses of Bitcoin against the assets analyzed here.

Tabla 3. Resumen de resultados

Serie |

Hedge |

Diversifier |

Safe haven |

TRM |

x |

✓ |

x |

EMBI |

✓ |

x |

x |

CCC TES TF CP (1 Y) |

✓ |

x |

x |

CCC TES TF MP (5 Y) |

✓ |

x |

x |

CCC TES TF LP (10 Y) |

✓ |

x |

x |

MSCI COLCAP |

x |

x |

x |

ECOPETL CB Equity |

x |

✓ |

x |

PFBCOLO CB Equity |

✓ |

x |

x |

ISA CB Equity |

x |

✓ |

x |

CDS |

✓ |

x |

x |

5. DISCUSSION

This study investigated the diversification, hedging, and safe-haven properties of Bitcoin against some Colombian financial assets. Statistically significant evidence was found to argue that Bitcoin can be a new alternative investment instrument in the Colombian economy due to its financial sustainability over time and volatility—which make it a suitable hedging mechanism against other assets in the market. This can include assets other than those ten evaluated in this study, especially because part of the data used here were obtained during the COVID-19 pandemic, a time when atypical data were to be expected. However, the values were not affected by the possible noise. What was indeed observed was a general strengthening of the Bitcoin price, although volatile. Clearly, the DCC model served as an adequate tool to achieve the research objectives of this study. In addition, this article sets a precedent so that Colombia starts to generate a culture of investment in digital assets because it has been proved that hedging strategies and diversification with other assets in the market can produce benefits with a lower risk.

This study was based on that by

The analysis presented above can serve as a basis for building portfolios with different Colombian financial assets. It can also be helpful for those who were constantly fearful of investing in cryptocurrencies so that they become interested in their operation. They can employ tools such as the findings of the DCC model, which, among others, can be used to explain the concept of investment risk and the need to mitigate it, thus contributing to more efficient decision-making.

6. CONCLUSIONS

From a financial perspective, these findings encourage investors in general to invest capital in the Colombian economy because there is another investment alternative, different from traditional ones: the world of crypto assets. Despite the implicit risks that investors run when they use cryptocurrencies as investment vehicles, we cannot ignore the opportunities that this market offers and its potential as part of the digital transformation. Therefore, due to the dynamics of cryptocurrencies and their growing relevance in society, we should expand our knowledge of them and understand them better. In other words, objective research in this field should enable different market agents to have a clear framework to make decisions, manage their portfolios, and, as a consequence, use better tools to generate strategies—all of this allowed by a definite regulatory system. Therefore, beyond any statistical or technical conclusion that indicates the viability of using cryptocurrencies, multidisciplinary research should close this knowledge gap and define their applicability.

Although the findings in this article enable investors to consider Bitcoin as an alternative to hedge their positions, their viability analysis should also take into account other important aspects; for example, Bitcoin liquidity and its applicability according to the regulations and the law depending on the type of investor, which were not explored in this study. Another important aspect is the impact of Bitcoin on the environment as it has been proved that using it requires high power consumption, which goes against environmental protection. Additionally, its network generates electronic waste. The characteristics of the cryptocurrency market pose a regulatory challenge for market agents, especially institutional investors who must necessarily comply with the regulations. It is a challenge because the regulating agencies should advocate for the existence of policies and limits for market risk management; liquidity; the money laundering and terrorist financing risk management system in Colombia (known as Sarlaft); and the operational risk management system in Colombia (known as Saro); among others. It is also a challenge because it is impossible to analyze cryptocurrencies using credits and counterparty risk due to their nature. Future studies should further examine the causes behind the floating nature of Bitcoin to clearly define its relationship with other financial assets over time. In any case, as institutional investors enter the scene, the dynamics and variability of its price could change.

Finally, the relative novelty of Bitcoin and its uses open the door to the construction of new theories about its benefits and risks. Future research should aim to explain the behavior of this cryptocurrency over time because, in order to decide if this digital resource should be accepted in different economies, it is essential to learn about the characteristics of its volatility. Thus, investors can determine if there are opportunities to assume this investment risk in the long term.

CONFLICTS OF INTEREST

The authors declare no conflict of financial, professional, or personal interests that may inappropriately influence the results that were obtained or the interpretations that are proposed here.

AUTHOR CONTRIBUTIONS

In this study, all the authors made a significant contribution, as follows:

Christian Daniel Escobar Anduquia: literature review, construction and interpretation of the statistical model, data analysis, results, discussion, and writing – original draft.

Sebastián Darío Avella Jiménez: introduction, conceptualization, data collection and analysis, conclusions, and writing – original draft.

Brayan Ricardo Rojas Ormaza: supervision, conceptualization, and writing – review and editing.

REFERENCES

- arrow_upward Al Guindy, M. (2021). Cryptocurrency price volatility and investor attention. International Review of Economics and Finance, 76, 556–570. https://doi.org/10.1016/j.iref.2021.06.007

- arrow_upward Akhtaruzzaman, M., Boubaker, S., Lucey, B., & Sensoy, A. (2021). Is gold a hedge or a safe-haven asset in the COVID–19 crisis? Economic Modelling, 102, 1-26. https://doi.org/10.1016/j.econmod.2021.105588

- arrow_upward Almasri, E., & Arslan, E. (2018). Predicting cryptocurrencies prices with neural networks. En 2018 6th International Conference on Control Engineering & Information Technology (CEIT), pp. 1-5. IEEE. https://doi.org/10.1109/CEIT.2018.8751939

- arrow_upward Altamira Vásquez, M., López-Castro, E. M., Santamaría Vicarte, G. V., & Hernández Trejo, L. (2020). El impacto de la volatilidad en la funcionalidad de las criptomonedas. Interconectando Saberes, 9(5), 201-212. https://doi.org/10.25009/is.v0i9.2659

- arrow_upward Álvarez Díaz, L. J. (2019). Criptomonedas: Evolución, crecimiento y perspectivas del Bitcoin. Población y Desarrollo, 25(49), 130-142. https://doi.org/10.18004/pdfce/2076-054x/2019.025.49.130-142

- arrow_upward Amaris Peñuela, L. J. (2015). Identificación de los determinantes del precio de bitcoin [Trabajo de pregrado, Universidad de los Andes]. https://repositorio.uniandes.edu.co/handle/1992/16943

- arrow_upward Aysan, A. F., Demirtaş, H. B., & Saraç, M. (2021). The Ascent of Bitcoin: Bibliometric Analysis of Bitcoin Research. Journal of Risk and Financial Management, 14(9), 427. http://dx.doi.org/10.3390/jrfm14090427

- arrow_upward Bañón González, G. (2018). Mercado de Derivados Financieros: Evolución, Análisis y Perspectivas de Futuro [Trabajo de pregrado, Universidad Pontificia COMILLAS]. https://repositorio.comillas.edu/xmlui/handle/11531/19372

- arrow_upward Barber, B. M., & Odean, T. (2008). All That Glitters: The Effect of Attention and News on the Buying Behavior of Individual and Institutional Investors. The Review of Financial Studies, 21(2), 785–818. https://doi.org/10.1093/rfs/hhm079

- arrow_upward Barroilhet Díez, A. (2019). Cryptocurrencies, economic and legal aspects. Revista Chilena de Derecho y Tecnología, 8(1), 29–67. https://doi.org/10.5354/0719-2584.2019.51584

- arrow_upward Baur, D. G., & Lucey, B. M. (2010). Is Gold a Hedge or a Safe Haven? An Analysis of Stocks, Bonds and Gold. Financial Review, 45(2), 217-229. http://dx.doi.org/10.1111/j.1540-6288.2010.00244.x

- arrow_upward Blahušiaková, M. (2022). Accounting for holdings of cryptocurrencies in the Slovak republic: Comparative analysis. Contemporary Economics, 16(1), 16-31. https://ssrn.com/abstract=4113186

- arrow_upward Bouri, E., Hussain-Shahzad, S. J., & Roubaud, D. (2020). Cryptocurrencies as hedges and safe-havens for US equity sectors. The Quarterly Review of Economics and Finance, 75, 294-307. https://doi.org/10.1016/j.qref.2019.05.001

- arrow_upward Bouri, E., Molnár, P., Azzi, G., Roubaud, D., & Hagfors, L. I. (2017). On the hedge and safe haven properties of Bitcoin: Is it really more than a diversifier? Finance Research Letters, 20, 192-198. https://doi.org/10.1016/j.frl.2016.09.025

- arrow_upward Callens, E. (2021). Financial instruments entail liabilities: Ether, bitcoin, and litecoin do not. Computer Law & Security Review, 40, 105494. https://doi.org/10.1016/j.clsr.2020.105494

- arrow_upward Chambi Condori, P. P. (2021). Diversificación de carteras de inversión con criptomonedas. Quipukamayoc, 29(60), 51–60. https://doi.org/10.15381/quipu.v29i60.20471

- arrow_upward Chica Ramírez, A. F., Rendón Bedoya, N. M., & Ardila, F. S. (2018). El bitcoin y el efecto que genera su desconocimiento en los inversionistas colombianos [Trabajo de pregrado, Tecnológico de Antioquia]. https://dspace.tdea.edu.co/handle/tda/410

- arrow_upward CoinMarketCap (s. f.). Today's Cryptocurrency Prices by Market Cap. https://coinmarketcap.com/

- arrow_upward Corbet, S., Meegan, A., Larkin, C., Lucey, B., & Yarovaya, L. (2018). Exploring the dynamic relationships between cryptocurrencies and other financial assets. Economics Letters, 165, 28-34. https://doi.org/10.1016/j.econlet.2018.01.004

- arrow_upward Daulay, R. S. A., Nasution, S. M., & Paryasto, M. W. (2017). Realization and addressing analysis in blockchain bitcoin. In IOP Conference Series: Materials Science and Engineering, Gotemburgo, Suecia, (pp. 012002). IOP Publishing. https://doi.org/10.1088/1757-899X/260/1/012002

- arrow_upward Domínguez Jurado, J. M., & García-Ruiz, R. (2018). Blockchain y las criptomonedas: el caso bitcoin. Oikonomics, Revista de economía, empresa y sociedad, (10), 58-73. https://doi.org/10.7238/o.n10.1813

- arrow_upward Doumenis, Y., Izadi, J., Dhamdhere, P., Katsikas, E., & Koufopoulos, D. (2021). A Critical Analysis of Volatility Surprise in Bitcoin Cryptocurrency and Other Financial Assets. Risks, 9(11), 207. http://dx.doi.org/10.3390/risks9110207

- arrow_upward Echavarría Wartenberg, D. (2019). Surgimiento de las ICOS: Implicaciones para el Caso Colombiano. Revista de Derecho Privado, (38), 143–172. https://doi.org/10.18601/01234366.n38.06

- arrow_upward Engle, R. F. (2002). Dynamic Conditional Correlation: A Simple Class of Multivariate Generalized Autoregressive Conditional Heteroskedasticity Models. Journal of Business & Economic Statistics, 20(3), 339-350. https://doi.org/10.1198/073500102288618487

- arrow_upward Gaviria Rada, M. (2018). Contabilidad de derivados: el resultado real de la operación [Tesis de maestría, Universidad EAFIT]. https://repository.eafit.edu.co/handle/10784/12883

- arrow_upward Gómez Salazar, J. (2021). Criptomonedas ¿una buena inversión? [Trabajo de pregrado, Universidad EAFIT]. https://repository.eafit.edu.co/handle/10784/29894

- arrow_upward Herrero Amorós, J. (2018). Modelado predictivo de la dirección del precio del Bitcoin utilizando índices de mercado, análisis de sentimientos en Twitter e índices de popularidad por término mediante Google Trends [Tesis de maestría, Universitat de les Illes Balears]. https://dspace.uib.es/xmlui/handle/11201/149283

- arrow_upward Hussain-Shahzad, S. J., Bouri, E., Roubaud, D., Kristoufek, L., & Lucey, B. (2019). Is Bitcoin a better safe-haven investment than gold and commodities? International Review of Financial Analysis, 63, 322-330. https://doi.org/10.1016/j.irfa.2019.01.002

- arrow_upward Ivanovski, K., & Hailemariam, A. (2023). Forecasting the stock-cryptocurrency relationship: Evidence from a dynamic GAS model. International Review of Economics & Finance, 86, 97-111. https://doi.org/10.1016/j.iref.2023.03.008

- arrow_upward Jaramillo Echeverry, L. (2021.). Portafolios diversificados con criptomonedas y su respectivo riesgo de mercado [Trabajo de pregrado, Universidad EIA]. https://repository.eia.edu.co/handle/11190/3358

- arrow_upward Lengyel-Almos, K. E., & Demmler, M. (2021). Is the Bitcoin market efficient? A literature review. Análisis Económico, 36(93), 167–187. https://www.scielo.org.mx/scielo.php?script=sci_arttext&pid=S2448-66552021000300167

- arrow_upward López, C. R., & Camberos, M. (2020). Aceptación y confianza de Bitcoin en México: una investigación empírica. Entre Ciencia e Ingeniería, 14(28), 16–25. https://doi.org/10.31908/19098367.2011

- arrow_upward López Jiménez, D. (2020). Globalización y robots ¿qué consecuencias pueden suscitarse de tal sinergia? Andamios, 17(44), 343-349. http://dx.doi.org/10.29092/uacm.v17i44.805

- arrow_upward López-Zambrano, C. R., Camberos-Castro, M., & Villareal-Peralta, E. M. (2021). Los determinantes de confianza y riesgo percibido sobre los usuarios de Bitcoin. Retos Revista de Ciencias Administrativas y Económicas, 11(22), 199–215. https://doi.org/10.17163/ret.n22.2021.01

- arrow_upward Mecheba Molongua, J. (2016). Bitcoin, ¿la moneda del futuro? [Trabajo de pregrado, Universidade da Coruña]. https://ruc.udc.es/dspace/handle/2183/18055

- arrow_upward Merkaš, Z., & Roška, V. (2021). The Impact of Unsystematic Factors on Bitcoin Value. Journal of Risk and Financial Management, 14(11), 546. http://dx.doi.org/10.3390/jrfm14110546

- arrow_upward Mokhtarian, E., & Lindgren, A. (2017). Rise of the Crypto Hedge Fund: Operational Issues and Best Practices for Emergent Investment Industry. Stanford Journal of Law, Business, and Finance, 23(1), 112-158. https://papers.ssrn.com/sol3/papers.cfm?abstract_id=3055979

- arrow_upward Montoya Ramírez, J. D. (2020). El bitcoin una innovación financiera [Trabajo de pregrado, Universidad Pontificia Bolivariana]. https://repository.upb.edu.co/handle/20.500.11912/5935

- arrow_upward Mota Aragón, B., & Núñez Mora, J. A. (2019). Estimación de la distribución multivariada de los rendimientos de los tipos de cambio contra el dólar de las criptomonedas Bitcoin, Ripple y Ether. Revista Mexicana de Economía y Finanzas Nueva Época REMEF, 14((3), 447-457. https://doi.org/10.21919/remef.v14i3.409

- arrow_upward Ordoñez Sánchez, S. G. (2021). Educación financiera basada en el bitcoin y la inclusión en planes de estudio. RIDE Revista Iberoamericana Para La Investigación Y El Desarrollo Educativo, 11(22). https://doi.org/10.23913/ride.v11i22.973

- arrow_upward Palacios Cárdenas, Z. J., Vela Avellaneda, M. A., & Tarazona Bermúdez, G. M. (2015). Bitcoin como alternativa transversal de intercambio monetario en la economía digital. Redes de Ingeniería, 6(1), 106–128. https://doi.org/10.14483/udistrital.jour.redes.2015.1.a08

- arrow_upward Pilacuán Cadena, J., Espinoza Herrera, X., Carreño Llaguno, S., & Palacios Alcivar, B. (2021). Criptomonedas: funcionamiento, oportunidades y amenazas. RES NON VERBA REVISTA CIENTÍFICA, 11(2), 174–193. https://doi.org/10.21855/resnonverba.v11i2.604

- arrow_upward Portero Lameiro, J. D., & Texeira Pereira, E. (2019). La relevancia del Bitcoin en las economías modernas. Revista Atlántica de Economía, 2(3). https://dialnet.unirioja.es/servlet/articulo?codigo=7407249

- arrow_upward Powell, K., & Hope, M. (2018). Shifting digital currency definitions: current considerations in Australian and US tax law. eJournal of Tax Research, 16(3), 594-619. https://heinonline.org/HOL/LandingPage?handle=hein.journals/ejotaxrs16&div=33&id=&page=

- arrow_upward Rathee, N., Singh, A., Sharda, T., Goel, N., Aggarwal, M., & Dudeja, S. (2023). Analysis and price prediction of cryptocurrencies for historical and live data using ensemble-based neural networks. Knowledge and Information Systems, 65, 4055–4084. https://doi.org/10.1007/s10115-023-01871-0

- arrow_upward Ratner, M., & Chiu, C.-C. (2013). Hedging Stock Sector Risk with Credit Default Swaps. International Review of Financial Analysis, 30, 18-25. https://doi.org/10.1016/j.irfa.2013.05.001

- arrow_upward Roa Mora, J. I. (2019). Análisis de las Alternativas del Diseño de un Sistema Difuso para la Predicción del Precio del Bitcoin (BTC). Revista Investigación e Innovación en Ingenierías, 7(1), 34-46. https://doi.org/10.17081/invinno.7.1.2996

- arrow_upward Rodas Portillo, A., & Núñez Gill, S. A. (2021). El Bitcoin: una revisión de las ventajas y desventajas de las transacciones comerciales con dinero virtual. Ciencia Latina Revista Científica Multidisciplinar, 5(6), 13040-13059. https://doi.org/10.37811/cl_rcm.v5i6.1306

- arrow_upward Rodríguez Gómez, J. L. (2020). Bitcoin, un activo de inversión alternativo [Tesis de maestría, Universidade da Coruña]. https://doi.org/10.13140/RG.2.2.28801.68968

- arrow_upward Sánchez Ascanio, L. C., & Arredondo García, J. A. (2020). Prediciendo el precio del Bitcoin, y más. Suma de Negocios, 11(24), 42–52. https://doi.org/10.14349/sumneg/2020.V11.N24.A5

- arrow_upward Sánchez Castaños, L. A. (2019). Contabilidad de cobertura: ¿formalidad para evitar asimetrías o principio de correlación? Contabilidad Y Negocios, 14(28), 6-35. https://doi.org/10.18800/contabilidad.201902.001

- arrow_upward Sandoval Ariza, L. K., & Rodríguez Piraquive, T. M. (2020). La tecnología Blockchain como mecanismo para transar contratos forward en Colombia [Trabajo de pregrado, Universidad Javeriana]. https://repository.javeriana.edu.co/handle/10554/52761

- arrow_upward Santillán-Salgado, R., Martínez-Preece, M., & López-Herrera, F. (2017). Análisis Econométrico del Riesgo y Rendimiento de las SIEFORES. Revista Mexicana de Economía y Finanzas Nueva Época REMEF, 11(1). https://doi.org/10.21919/remef.v11i1.76

- arrow_upward Sarmiento Suárez, J. E., & Garcés Bautista, J. L. (2016). Criptodivisas en el entorno global y su incidencia en Colombia. Revista Lebret, (8), 151-171. https://doi.org/10.15332/rl.v0i8.1691

- arrow_upward Smales, L. A. (2022). Investor attention in cryptocurrency markets. International Review of Financial Analysis, 79, 101972. https://doi.org/10.1016/j.irfa.2021.101972

- arrow_upward Stensås, A., Nygaard, M. F., Kyaw, K., & Treepongkaruna, S. (2019). Can Bitcoin be a diversifier, hedge or safe haven tool? Cogent Economics & Finance, 7(1), 1-17. https://doi.org/10.1080/23322039.2019.1593072

- arrow_upward Urdaneta Montiel, A. J., Carvallo Monsalve, Y. E., & Borgucci García, E. V. (2020). Bitcoin y la teoría monetaria de Friedman y Mises. Evidencias estadísticas. Revista de Ciencias Sociales, 26(4), 246–259. https://doi.org/10.31876/rcs.v26i4.34661

- arrow_upward Valencia Marín, F. D. (2021). Panorama actual del bitcoin. Una descripción práctica y jurídica de las criptomonedas en Colombia y Ecuador. Foro: Revista de Derecho, (36), 49–71. https://doi.org/10.32719/26312484.2021.36.3

- arrow_upward Vásquez Leiva, M. (2014). Bitcoin: ¿Moneda o Burbuja? Revista Chilena de Economía y Sociedad, 8(1 y 2), 52–61. https://rches.utem.cl/articulos/bitcoin-moneda-o-burbuja/

- arrow_upward Zhukov, S. V., Kopytin, I. A., & Maslennikov, A. O. (2019). Fintech ecosystem: the largest private cryptosystems. International Processes, 17(1), 22-37. https://doi.org/10.17994/IT.2019.17.1.56.2